WHAT ARE MUTUAL FUNDS?

A mutual fund is a pool of money managed by a professional Fund Manager.

It is a trust that collects money from a number of investors who share a common investment objective and invests the same in equities, bonds, money market instruments and/or other securities. And the income / gains generated from this collective investment is distributed proportionately amongst the investors after deducting applicable expenses and levies, by calculating a scheme’s “Net Asset Value” or NAV. Simply put, the money pooled in by a large number of investors is what makes up a Mutual Fund.

Here’s a simple way to understand the concept of a Mutual Fund Unit.

Let’s say that there is a box of 12 chocolates costing ₹40. Four friends decide to buy the same, but they have only ₹10 each and the shopkeeper only sells by the box. So the friends then decide to pool in ₹10 each and buy the box of 12 chocolates. Now based on their contribution, they each receive 3 chocolates or 3 units, if equated with Mutual Funds.

And how do you calculate the cost of one unit? Simply divide the total amount with the total number of chocolates: 40/12 = 3.33.

So if you were to multiply the number of units (3) with the cost per unit (3.33), you get the initial investment of ₹10.

This results in each friend being a unit holder in the box of chocolates that is collectively owned by all of them, with each person being a part owner of the box.

Next, let us understand what is “Net Asset Value” or NAV. Just like an equity share has a traded price, a mutual fund unit has Net Asset Value per Unit. The NAV is the combined market value of the shares, bonds and securities held by a fund on any particular day (as reduced by permitted expenses and charges). NAV per Unit represents the market value of all the Units in a mutual fund scheme on a given day, net of all expenses and liabilities plus income accrued, divided by the outstanding number of Units in the scheme.

Mutual funds are ideal for investors who either lack large sums for investment, or for those who neither have the inclination nor the time to research the market, yet want to grow their wealth. The money collected in mutual funds is invested by professional fund managers in line with the scheme’s stated objective. In return, the fund house charges a small fee which is deducted from the investment. The fees charged by mutual funds are regulated and are subject to certain limits specified by the Securities and Exchange Board of India (SEBI).

India has one of the highest savings rate globally. This penchant for wealth creation makes it necessary for Indian investors to look beyond the traditionally favoured bank FDs and gold towards mutual funds. However, lack of awareness has made mutual funds a less preferred investment avenue.

Mutual funds offer multiple product choices for investment across the financial spectrum. As investment goals vary – post-retirement expenses, money for children’s education or marriage, house purchase, etc. – the products required to achieve these goals vary too. The Indian mutual fund industry offers a plethora of schemes and caters to all types of investor needs.

Mutual funds offer an excellent avenue for retail investors to participate and benefit from the uptrends in capital markets. While investing in mutual funds can be beneficial, selecting the right fund can be challenging. Hence, investors should do proper due diligence of the fund and take into consideration the risk-return trade-off and time horizon or consult a professional investment adviser. Further, in order to reap maximum benefit from mutual fund investments, it is important for investors to diversify across different categories of funds such as equity, debt and gold.

While investors of all categories can invest in securities market on their own, a mutual fund is a better choice for the only reason that all benefits come in a package.

A PLETHORA OF SCHEMES TO CHOOSE FROM

Mutual funds are favoured globally for the variety of investment options they offer. There is something for every profile and preference.

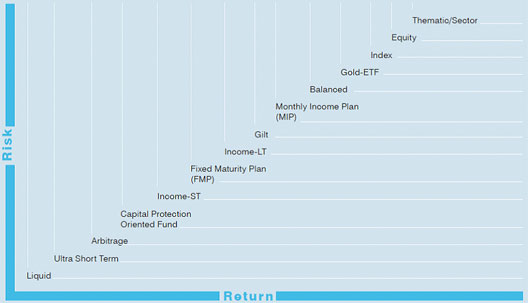

Chart 1: Risk/Return trade-off by mutual fund category

TYPE OF MUTUAL FUND SCHEMES

Mutual Fund schemes could be ‘open ended’ or close-ended’ and actively managed or passively managed.

OPEN-ENDED AND CLOSED-END FUNDS

An open-end fund is a mutual fund scheme that is available for subscription and redemption on every business throughout the year, (akin to a savings bank account, wherein one may deposit and withdraw money every day). An open ended scheme is perpetual and does not have any maturity date.

A closed-end fund is open for subscription only during the initial offer period and has a specified tenor and fixed maturity date (akin to a fixed term deposit). Units of Closed-end funds can be redeemed only on maturity (i.e., pre-mature redemption is not permitted). Hence, the Units of a closed-end fund are compulsorily listed on a stock exchange after the new fund offer, and are traded on the stock exchange just like other stocks, so that investors seeking to exit the scheme before maturity may sell their Units on the exchange.

ACTIVELY MANAGED AND PASSIVELY MANAGED FUNDS

An actively managed fund is a mutual fund scheme in which the fund manager “actively” manages the portfolio and continuously monitors the fund’s portfolio , deciding on which stocks to buy/sell/hold and when, using his/her professional judgement, backed by analytical research. In an active fund, the fund manager’s aim is to generate maximum returns and out-perform the scheme’s bench mark.

A passively managed fund, by contrast, simply follows a market index, i.e., in a passive fund , the fund manager remains inactive or passive inasmuch as, he/she does not use his/her judgement or discretion to decide as to which stocks to buy/sell/hold , but simply replicates / tracks the scheme’s benchmark index in exactly the same proportion. Examples of Index funds are an Index Fund and all Exchange Traded Funds. In a passive fund, the fund manager’s task is to simply replicate the scheme’s benchmark index i.e., generate the same returns as the index, and not to out-perform the scheme’s bench mark.

What is a Mutual Fund? Understand its Meaning, Types and Benefits

Gone are the days, when people invested only in traditional financial instruments to earn a secured and guaranteed return upon maturity. These days, people are increasingly relying on mutual funds to earn high returns and grow their money. But before you decide to take a pick and invest in it, it is crucial to understand what is mutual fund to ensure optimal growth of your hard-earned money.

What is a Mutual Fund?

A mutual fund is a financial mechanism that accumulates assets from different shareholders and invests the money into a diverse portfolio of securities. Typically, a mutual fund contains various types of securities like bonds, stocks, money market and other financial instruments. Managed by professional investment managers or advisers, mutual funds are designed and structured to offset the losses with gains from different kinds of securities. Here the fund managers are obligated to ensure the best interest of the shareholders and fetch them returns from their investments. Alongside, the mutual funds are regulated by the Securities and Exchange Board of India (SEBI).

A mutual fund thus allows individual or small investors to buy shares and get access to a professionally managed fund where they can earn returns and grow their money. The price of the share is calculated as the Net asset value (NAV) or per unit value of the fund calculated as the total fund value divided by the total number of shares. Each shareholder thus profits from the fund’s gains and loses money when it goes into losses. Investing the pool of money into a diversified set of securities, the funds also aim to balance losses from one, with returns from the other.

Why invest in mutual funds?

Knowing just the mutual fund definition or the mutual fund meaning doesn’t arm you enough to invest in it. With that, clarity regarding why you should invest in mutual funds is needed. So, let us now focus on the reasons that make mutual fund investments a fruitful choice.

- Expert help

A classic comparison to investment in mutual funds can be cooking. Unless you hone a certain amount of skill in it, will it be wise to invite people for dinner? Guess not. Rather, hiring someone skilled to cook can be a better decision here, who will not only save time but will be able to earn accolades from your guests for a sumptuous meal.

Similar is the case of investment in market-linked financial instruments. Here also, without a certain level of understanding and skill in fund management, it will be rather difficult to avoid losses and earn returns. Instead seeking an expert’s help is always beneficial.

This is exactly where investing in mutual funds can be a wise choice. Mutual funds are managed by experienced investment professionals who strategize the investment in various securities to earn returns for the shareholders. So, by investing in a mutual fund, you can surely benefit from their expertise. - Reduce risks

Mutual funds invest your money into various categories of securities like stocks, bonds, money market instruments etc. and not in any one asset. Thus, even if there’s a loss-making instrument in your portfolio, it will surely be balanced by returns from another. Moreover, there’s scope to avail of hassle-free investment through mutual funds. For instance, if you need to pick and choose your stocks and diversify, you’ll have to spend considerable time selecting at least 10 of them from different sectors to avoid losses before you invest. A mutual fund gives you an instant choice of a diverse portfolio, where you get access to a much higher number of stocks in a single fund. This, in turn, reduces the overall risk by a considerable amount. - Better Returns

Mutual funds automatically provide you with a scope of higher returns compared to traditional investments. This is because a mutual fund is market-linked and invests its assets in high-return stocks that yield high value when the market performs well. Contrarily, a traditional investment is not linked to the market and can only fetch you a pre-defined assured income. - Tax deductions

Earnings from a mutual fund can earn you income tax deductions of up to Rs 1.5 lakhwhen you invest in Equity linked Savings Scheme (ELSS). This tax benefit is available under section 80C of the Income Tax Act, 1961. Debt funds can also fetch you indexation benefit which is another form of tax deductions. Unlike traditional instruments where all interests earned are taxable, for debt mutual funds taxes are payable only on returns over and above the inflation rate.

How do mutual funds work?

Before you decide to invest in a mutual fund, make sure you know in detail how it works and generates returns. This will help you to estimate the amount you need to invest and the probable returns that can be earned through it. So, here’s a detailed guide to the operations of a mutual fund.

For any mutual fund, start by calculating its NAV or per unit value by dividing the total fund value by the total number of units held by the shareholders. This value goes up and down with the market’s performance and the share price of a mutual fund is the value at which NAV settles at the end of the day. Furthermore, as the portfolio changes its structure in terms of underlying investments, NAV changes as well, depicting the fund’s performance. Depending on the current NAV, the investors can buy or sell shares of a mutual fund to earn higher returns and avoid losses when the market oscillates between the bull and bear mode. Buying and redeeming units thus enable the shareholders to enter or exit the fund depending on the market condition. Following are the benefits to look for in the operations of a mutual fund.

- Expert management: A mutual fund is managed by an investment expert who can understand the market fluctuations better and strategize accordingly.

- Diversification: A mutual fund allows the investor to put his money into a range of assets and enjoy lesser risk compared to investments in a single asset class.

- Better access: Through a mutual fund, any small investor gets access to a diverse portfolio, which would otherwise require a huge investment had he/she individually picked the financial instruments to invest in.

- Affordable investment: ASystematic Investment Plan (SIP) allows investing small amounts, making mutual funds an easy and affordable choice for many.

- Liquidity and flexibility: Units of mutual funds can be bought or sold on most of the business days, thus adding liquidity and flexibility to your investment.

- Varied investment: Mutual fund offers a diverse portfolio of securities that caters to every risk appetite, investment need, and time frame.

- Tax benefits: Some mutual funds like the ELSS scheme come with tax deductions, helping the shareholders enjoy higher post-tax returns.

- Transparent operation: Mutual funds keep regularly updating shareholders about the fund performance, their holdings and other relevant information Thus, the fund operation remains transparent.

- Regulation: Under the strict vigilance and regulations of SEBI, mutual funds offer to the shareholders protection of capital, higher transparency and fair operation.

Types of mutual funds

There are various forms of mutual funds operating in the market with varied structures, nature of security and probable returns. However, there are four broad categories, that require your attention and understanding. They are Stock funds, Bond funds, Money market funds and Target date funds. All the different varieties of mutual funds fall under any of these broad categories. Let us now delve deeper into the classification.

- Stock Funds

Clear from the name itself, these funds majorly invest in equities or stocks with a probability of higher returns coupled with higher risks. Some of these funds are further categorized by the size of the companies they invest in small-cap, mid-cap and large-cap. Some stock funds are classified by whether they invest in domestic or foreign company equities, while some are named in terms of their pattern of investment—aggressive growth, income-based, value-oriented and others. Based on the size and market cap of companies, as well as the growth potential of stocks, there is a further classification of stock funds as value funds targeting low-growth, high-quality companies and growth funds investing in companies with high growth of income, sales and cash flow. There is a blend fund category as well which falls midway between growth and value funds. - Bond funds

Bond funds guarantee a certain amount of return and thus are of a fixed income nature. These funds are mainly investment in Government bonds, corporate bonds or any other debt instrument that offer a fixed rate of return and regular interest is paid to the shareholders. However, not all bond funds are devoid of market risk, a classic example of which is high-return junk bonds. Depending on the nature of the companies they invest in, bond fund has many varieties and come with interest risks. - Money market funds

Money market funds are designed to protect the capital as they majorly invest in short-term, risk-free debt instruments of the money market like the Government treasury bills. Here the returns aren’t huge, offering little more returns than a savings account, but the principal is safe from the market volatility. - Income funds

Income funds are typically meant to provide a steady cash flow of current income to the shareholders. Thus, they majorly invest in secure Government and corporate debt till their maturity to ensure interest streams. - Balanced Funds

These funds, also known as asset allocation funds invest in a combination of stocks, bonds, money market instruments and other alternative asset classes, reducing the risk of exposure. Catering to different investor objectives, market fluctuations and evolving business cycles, balanced funds come with the switching of allocation percentages. However, there’s another category of it, that follows a fixed allocation strategy, ensuring predictable risk exposure. - Index funds

Index funds usually invest in stocks that follow a major market index like the Dow Jones Industrial Average or S&P 500. With less market knowledge or research required, shareholders incur fewer expenses, making these funds a good choice for cost-sensitive investors. - International and Global Funds

Global funds have the flexibility to invest anywhere in the world while international funds can target assets in the rest of the world, leaving out the investor’s home country. Here, the returns depend on the market volatility of the respective countries where the investments have been made. - Speciality funds

These funds target assets of a specific area and are named accordingly. Sector funds, for instance, aim to invest in specific sectors of the economy like technology, education, healthcare etc, thus making the returns highly volatile. A region fund on the other hand chooses specific geographical regions to invest in, while ethical or socially responsible funds invest in such companies only that follow a social cause and related guidelines. For example, these funds won’t invest in companies producing alcohol, tobacco, weapons, or nuclear power. - Exchange Traded Funds

These funds are typically not mutual funds but follow similar and consistent strategies. Structured as trusts treading on stocks, they offer buying and selling throughout trading days, lower fees compared to mutual funds, more cost efficiency and tax benefits.

How to invest in mutual funds?

Are you looking to grow your wealth through mutual fund investments? No worries, you can invest in a mutual fund through a set of easy and simplified steps. They are:

- Pick a platform: Check, and compare the popular mutual fund investment platforms and choose the most reliable one only after thorough research.

- Select a fund: Depending on your budget, financial goals and risk appetite, pick the best-fit fund from the set of available options. Remember to check carefully the objectives of the fund, its performance over a period of time, the securities in the portfolio where your money will be invested and the pattern of their risk profile. This will lead to an efficient and intelligent selection.

- Invest the amount: Aligning to your goals and affordability, decide on the amount to be invested and make the online payment.

- Stay updated: Keep monitoring your fund’s performance based on the market conditions. This will help you to keep a check on whether the fund stays aligned with your financial needs.

- Manage your fund: Depending on the volatility of the market and your fund’s response to it, make adjustments if necessary. However, the point that needs to be noted here is, that you don’t get to choose the securities or the allocation of assets in a mutual fund portfolio. It’s the sole responsibility of the designated fund manager. Depending on your evolving needs or the fund’s varying performance you can choose to buy or sell units you hold in the fund.

Advantages of mutual fund investing

There are certain advantages of investing in a mutual fund. Here is the list:

- Mutual funds are managed by efficient investment experts who can do justice to your hard-earned money.

- You can invest a small amount, yet get access to a wide variety of assets for investment.

- A diversified portfolio across different asset classes minimizes the risk of loss.

- You get to buy or sell fund units at any point in time to optimize your returns.

- Mutual fund offers an array of investment schemes designed for different investor goals and profiles.

Disadvantages of mutual fund investing

There are certain disadvantages associated with mutual fund investments. It’s better to be aware of them beforehand.

- Mutual funds operate on market-linked instruments and are hence exposed to market risks.

- Subject to market volatility, mutual funds don’t guarantee returns on the investment.

- To invest in these funds, you need to bear a set of costs like fund management fees, exit load and other expenses which pull your returns down.

- Here, the portfolio management is done by the fund manager only and the shareholder doesn’t have the power to choose the securities for his/her portfolio.

Tips for investing in mutual funds

Mutual fund investment is no rocket science. Here are some tips for an efficient investment in these funds.

- Before investing, make sure you do thorough research on your chosen fund and get clarity on its performance, objectives, risks associated and fees involved.

- Do not rush with investments. Start with small amounts and gradually get into the habit. This will help you form a proper understanding of the market and make informed choices of mutual fund investments.

- Make regular investments to maximize the power of compounding.

- Keep your investments aligned to your financial targets and rebalance the portfolio as and when necessary. Sell units to avoid losses while buying more when the market is showing potential for higher returns.

Mutual fund fees

To invest in a mutual fund, you need to incur a set of costs referring to mutual fund fees. This includes different fees for various associated services. For example, the annual operating fee payable by the shareholders is basically an annual percentage, usually 1-3% of the funds under management, charged towards fund management services and administration costs. The shareholder fees on the other hand include sales charges, redemption and commission fees which are directly paid by the investors during purchase and sales. Commissions or sales charges on the other hand are termed as load of the mutual fund— front-end load at the time of purchase of the share while back-end load is applicable during the sale of the units. However, there are no-load funds too, where no commissions or sales charges are payable. But there are some funds, that require paying fees for early withdrawals or selling before maturity.

Alternate investment options

If you are looking for investment opportunities that can help you with guaranteed returns then you can definitely evaluate life insurance savings plan. This type of financial instrument can help you build your corpus as well as provide life cover. Savings plan can help you fulfil your financial goals as well as secure your financial future.

Conclusion

While there are market risks associated, an efficiently managed mutual fund can act wonders in terms of higher returns and growing wealth. But to reap the benefits in full, it’s immensely important to understand what are mutual funds, their process of working and their mutual fund’s meaning and types. The more you know the mechanism, the higher the chances of getting proper returns despite the market volatility. However, choose to invest in a mutual fund and pick a specific category, depending on your willingness and ability to take risks. This will ensure a satisfactory investment.